Navigating the Future of Finance: Intersecting Facts for Success

The world of finance is ever evolving, driven by advancements in technology, shifting market dynamics, and changing consumer behaviors. To stay ahead in this dynamic landscape, it is essential to understand the intersecting facts of both the present and the future. In this blog, we will explore some of the best-of-the-best insights that can help you navigate the future of finance and achieve success.

|

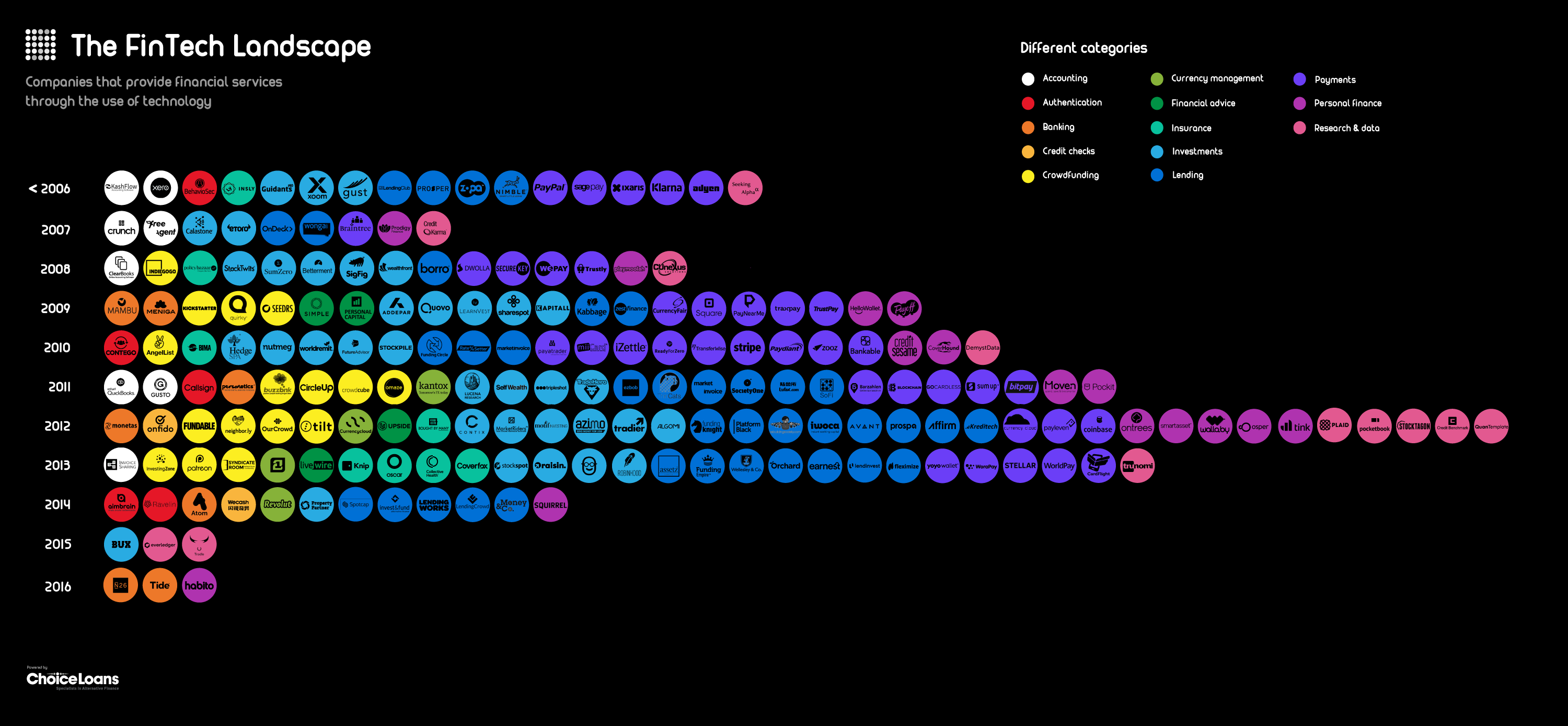

The Rise of FinTech:

The present financial landscape is witnessing a seismic shift with the rapid rise of FinTech. From mobile banking to peer-to-peer lending, technology is reshaping traditional finance. Looking to the future, we can expect even more disruptive innovations like blockchain, artificial intelligence, and decentralized finance (DeFi). Embracing these technologies will be crucial for financial institutions to enhance efficiency, improve customer experiences, and drive innovation.

Embracing Digital Transformation:

Digital transformation is no longer an option; it is a necessity. The pandemic has accelerated the shift towards digital channels, and the trend is here to stay. Financial institutions must prioritize the development of seamless online experiences, robust cybersecurity measures, and personalized digital services. Additionally, embracing open banking initiatives will allow for collaboration with third-party providers, creating a more connected and customer-centric financial ecosystem.

Sustainable Finance:

Environmental, social, and governance (ESG) factors are gaining prominence in the financial industry. Presently, we witness a growing demand for sustainable investments, ethical banking practices, and responsible corporate behavior. The future of finance will see an increased focus on integrating ESG considerations into investment decisions, risk assessments, and reporting. Incorporating sustainable finance practices can not only contribute to a greener planet but also unlock new business opportunities and attract conscientious investors.

Data-Driven Decision Making: Data has become the lifeblood of finance, driving insights and informing strategic decisions. Presently, businesses harness the power of big data analytics to understand customer behavior, manage risks, and optimize operations. In the future, as data volumes continue to explode, advancements in machine learning and predictive analytics will allow for more accurate forecasting, improved fraud detection, and enhanced customer personalization. Organizations that leverage data effectively will have a competitive edge in the financial landscape.

Regulatory Changes and Compliance: The finance industry is subject to a myriad of regulations, aimed at safeguarding the interests of consumers and maintaining market stability. Staying compliant with existing regulations is crucial, but it is equally important to anticipate future changes. The present regulatory landscape focuses on enhancing transparency, protecting data privacy, and preventing financial crimes. Looking ahead, emerging technologies like decentralized finance and cryptocurrencies will necessitate updated regulations to address associated risks while fostering innovation.

Conclusion:

To succeed in the future of finance, it is essential to pay attention to the intersecting facts of both the present and the future. Embracing FinTech, driving digital transformation, incorporating sustainable finance practices, leveraging data, and staying compliant with regulations are critical steps towards success. By adapting to these emerging trends and being proactive in embracing change, financial institutions and professionals can unlock new opportunities, create meaningful customer experiences, and secure a prosperous future in the ever-evolving financial landscape.

Comments

Post a Comment